👨🏻🍳Joseph’s Page | Anthony’s Page 🏄🏽♂️

Dear Loan Librarians,

Big Break for Buyers — Rates Slide to Yearly Lows! Two special deliveries in one-week (don’t worry - we will not flood your inbox) UNLESS it’s with impactful professional & investor loan insight, news or deals (like THE LOWEST MORTGAGE RATES of 2025!) - rates have dropped to 6.19%

⬇️ In This Volume:

Opinion: Get Ready for a RE BOOM

2026 - Increased Conforming Loan Limits

NON-QM (Alternative income & asset verification) Spotlight: Asset Depletion & DSCR

Fixed Second Lien Programs up to $500K (Primary, Second, Investment)

JUMBO ARM Specials

Residential Deal of the Week

OUR MISSION is to be the final BOOKmark for your go-to mortgage & loan officer team.👏🏼 With 40+ years of combined lending experience and the power of our 240+ Lenders - we dare you to compare! Explore & Share: specialmortgageoffers.com

The real estate industry drives 14–18% of the U.S. GDP, touching everything from construction to retail. When the next housing boom hits, it’ll ripple across the entire economy—benefiting builders, lenders, brokers, and small businesses alike.

The key trigger? Mortgage rates dropping below 5.5%. While some homeowners are locked into 2–3% loans, nearly two-thirds of Americans have rates between 3% and 6%—and they’re ready to move when affordability improves.

Translation: once rates dip, the market could ignite fast.📈

📌IMPORTANT MORTGAGE NEWS: 2026 CONFORMING LOAN LIMITS INCREASE!

📊 MORTGAGE PROGRAMS

💰Asset Depletion Qualification Loans

Did you know that you don’t have to sell your portfolio or assets to utilize them to qualify? Instead - borrowers can use their money market or retirement account funds as ‘income’ to qualify. Here’s how: Multiply the proposed payment by two-ish (40% DTI) then take 70% of the value of the portfolio and divide it by 60-84 months. If the balance is sufficient to cover the ‘proposed’ payment, high-asset borrowers can qualify for near conventional loan rates (MUCH BETTER THAN DSCR!)

🥈Closed-End Second Liens are the perfect way to turn built-up equity into opportunity—whether your clients need funds for home improvements, debt consolidation, or new investments.

Credit Score down to 680

Max LTV Up to 90%

Max Loan Amount $750,000

Max Loan Amount up to $350,000 on DSCR

Max Combined Loan Amount $3.5 million

Full Doc, Bank Statements, P&L, WVOE and DSCR

Primary, Second Homes or Investments

Loans up to $750,000 with a minimum of $150,000

Cash-out or rate-term refinance

Owner-occupied, second homes, and investment properties

12 or 24 months’ business bank statementsFull doc (2 years’ tax returns and YTD P&L, or 2 years W-2’s with YTD pay stubs for non-self-employed)

Rates are 30-year fixed, 20-year fixed, 15-year, or 10-year fixed

Up to 50% DTI, depending on LTV

On 1-Unit SFR with a loan amount of $250,000 or less, 2055 exterior appraisal with AVM can be utilized in lieu of full appraisal. AVM must have a high or medium confidence score.

Why Investors Love It💚

• Keeps the first mortgage intact — no need to refinance

• Fixed-rate stability and predictable payments

• Loan amounts up to $500,000

• Available for primary, second homes, and investment properties

• Fast approvals with common-sense underwriting

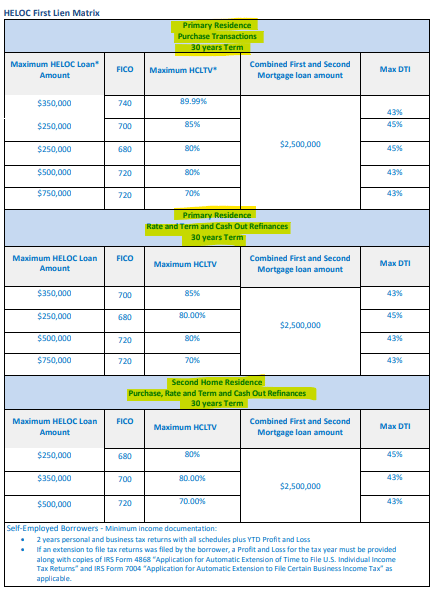

🏦First Lien HELOC Example Program

Amount:

· Up to $750,000

Loan Purpose:

· Purchase Money, Rate and Term Refinances and Cash Out Refinances

Minimum Draw:

· $100,000

Appraisal Requirement:

· Full URAR Appraisal is required

🧮 Example No-Ratio Program - Primary & 2nd Homes - When income docs don’t work, we do. This loan requires:

No Income or DTI Requirements

Up to $2.5M Loan Amount ($3M with exception)

80% Max LTV for Purchase/Rate-Term

75% Max LTV for Cash-Out

No Cash-Out Seasoning

620 Min FICO

100% Gift Funds Allowed (for down payment & closing costs)

💡Example DSCR Loan Programs (Debt-Service-Coverage-Ratio)

No Seasoning on Cash-Out Refinances: Unlock equity immediately.

No Current Appraised Value Seasoning: Just renovated? We use the most recent appraisal.

No Chain of Title Seasoning: Need to add a new borrower to title? No problem!

Vacant Properties - we lend on vacant properties.

Recently Listed Properties - off MLS by closing.

Fair Market Rent or Current Rent - use whichever is Greater!

Weekly Rate & Program Highlights

🐘 JUMBO ARM rates are reaching enticing levels with one of our premier jumbo lenders. Intended for prime conventional borrower of primary and secondary residences the 5/1 & 7/1 terms are currently pricing in the low 5%’s and departing residence DTI can be removed from qualifying ratios!

Working on a luxury purchase that requires additional buyer incentives and elite attentive client care? Call Joseph 24/7/365 @ 954-480-7478

🚒 Seller Concessions are HOT: Did you know that on second home loans the maximum seller paid concession with as little as 10% down is 6% of the sales price!?

Below is a Seller Concession Cheat Sheet:

🧾Residential Real Estate DEAL OF THE WEEK | Oceanfront Turn-Key STR

Oceanfront Commercially zoned STR just two hours from Portland! Ask for details*

Have a deal to shop or share? Email us for a feature or quick quote!

🧑🏼🎤Pro Realtor & Investor Concierge: Are you a Realtor closing 10+ Deals annually or an individual investor with more than 3+ properties owned? Ask about our repeat client and portfolio programs that centralize operations. Book your 15 minute Private Mortgage Consultation here.

Call, text or email us anytime,

🟠 Joseph Chiofalo | Loan Factory | Licensed NMLS Mortgage Broker

📲954-480-7478 📧 [email protected] | LIVE QUOTES ☑️

👁🗨Anthony AJ Wong | Loan Factory | Licensed NMLS Mortgage & Licensed OR + CA Real Estate Broker - Sesemi STR Brokers Powered by Fathom Realty

📲541-800-0455 📧 [email protected] | Shop OR STRs🌲